Transaction Center & VPOS Support

Configure Fraud Screening

Due to the fact that card-not-present credit card transactions traditionally carry a higher potential for fraud, the credit card industry uses two tools to help E-Commerce merchants determine the legitimacy of any transaction. These tools are the Address Verification Service (AVS) and Card Verification Value (CVV2) codes. These codes are returned from the card issuing banks when an authorization is obtained.

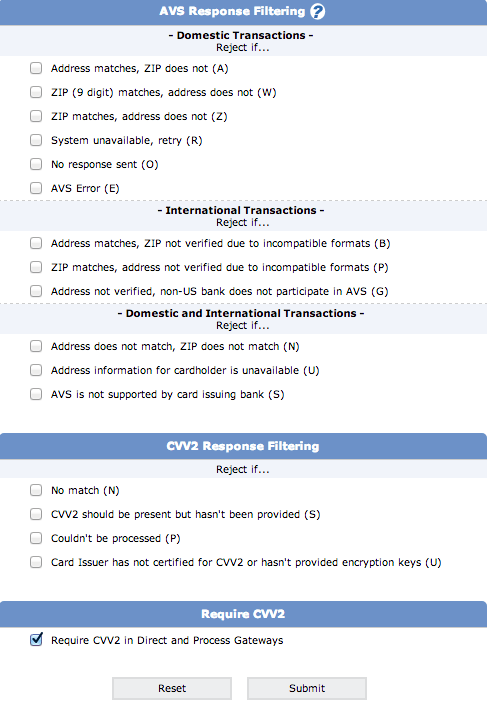

Setting AVS and CVV2 Filters

To set your AVS and CVV2 filters:

- Navigate to Security Settings Fraud Screening. This is where you can change your filtering options for the transactions that you process. You can choose to reject transactions that are processed through the system based on various responses that come back from the bank processor. You can also choose to reject transactions based on the response that comes from the bank based on the CVV2 number the customer provided with their credit card.

- Click on the check box next to each response you would like to reject.

Recommended Minimum Settings: We recommend that you reject at least the N responses for both the AVS and CVV2 checks. Fraudulent transactions will frequently have an N response for either the AVS or CVV2 check, so by rejecting any sale where this value is returned will provide you some protection against fraudulent transactions. You may elect to reject other responses based upon your business's needs; merchants providing goods or services in higher-risk markets or selling high-ticket items may need to be more cautious and thus be more restrictive in their AVS and CVV2 settings.

- Click the Submit button at the bottom of the screen to save your changes.

Full list of AVS Responses by Card

Visa

- Y: Address and 5-digit ZIP code both match

- A: Address matches, ZIP does not

- S: AVS not supported by card issuer

- R: Card issuer's AVS authorization system is unavailable; try again

- U: Unable to perform address verification because either address information is unavailable or card issuer does not support AVS

- Z: 5- or 9-digit ZIP code matches; Address does not match

- N: No match on either street address or ZIP

- G: Address not verified (International)

- E: Transaction is ineligible for address verification

- B: Address matches, ZIP could not be verified

- P: ZIP matches, address could not be verified

- C: Address and ZIP could not be verified due to incompatible formats (International)

- D: Address and ZIP both match (International)

- I: Address could not be verified (International)

- M: Address and ZIP both match (International)

- F: Address and ZIP both match (UK Only)

MasterCard

- Y: Address and 5-digit ZIP code both match

- A: Address matches, ZIP does not

- S: AVS not supported by card issuer

- R: Retry; system is unable to verify address

- U: No data returned from card issuer

- Z: 5-digit ZIP code matches, address does not match

- N: No match on either street address or ZIP

- W: 9-digit ZIP code matches, address does not match

- X: Both address and ZIP code match.

- F: Address and ZIP both match (UK Only)

Discover

- Y: Address matches, ZIP does not

- A: Address and ZIP code both match

- U: Unable to verify address

- Z: ZIP code matches, address does not

- N: No match on either street address or ZIP

- W: Cardholder not found in Address/ZIP file or Address/ZIP not available

- X: Address and ZIP code both match

- T: 9-digit ZIP matches, address does not match

American Express

- Y: Address and ZIP code both match

- A: Address matches, ZIP code does not

- S: AVS not supported at this time

- R: Card issuer's AVS authorization system is unavailable; try again

- U: Information unavailable (International, will not be returned for Canadian cardholders)

- Z: ZIP code matches, address does not

- N: No match on either street address or ZIP

Full List of CVV2 Responses

- M: Match

- N: No Match

- P: Not processed, CVV2 could not be verified

- S: Issuer indicates that the CVV2 should be present on the card, but no CVV2 data was entered with transaction

- U: Issuer does not support CVV2

- No response/blank: Check failed either because CVV2 value entered is incorrect or no CVV2 value was entered

Authorizations for Transactions Declined for AVS and/or CVV2

AVS and CVV2 response codes are only sent by the card issuing bank when a charge is authorized. When the gateway receives the response from the card issuing bank, the AVS and CVV2 codes returned are checked against the codes you have elected to reject. If the AVS or CVV2 code matches a response you are rejecting, the gateway will fail the transaction and issue an immediate reversal. For further explanation of authorizations and how they affect the card balance, see authorizations vs. settlements.